Hotel Profitability Hits New High: CoStar Reports GOPPAR at $73.60 in 2024

THE U.S. HOTEL industry saw limited profit growth in 2024 as rising labor costs and inflation offset revenue gains from higher demand, according to CoStar’s 2024 P&L data. GOPPAR growth slowed toward the end of the year, falling behind inflation, but still rose year over year.

In 2024, GOPPAR reached $73.60, up 3.2 percent from 2023. TRevPAR stood at $209.67, marking a 7.2 percent rise, while EBITDA PAR amounted to $51.88, up 2.5 percent. Labor costs increased to $72.44, rising 11.2 percent.

“Growth in total operating expenses, especially labor, has had the biggest impact on profits,” said Raquel Ortiz, STR’s senior manager of financial performance. “GOPPAR continued to slow at year-end, with growth falling behind inflation. On the positive side, demand growth has been key to driving total revenues, which have been the best defense against high expenses and allowed hotels to increase profits, albeit minimally. An increase in group business has helped improve F&B revenues, but not enough to offset the labor cost growth that has impacted margins.”

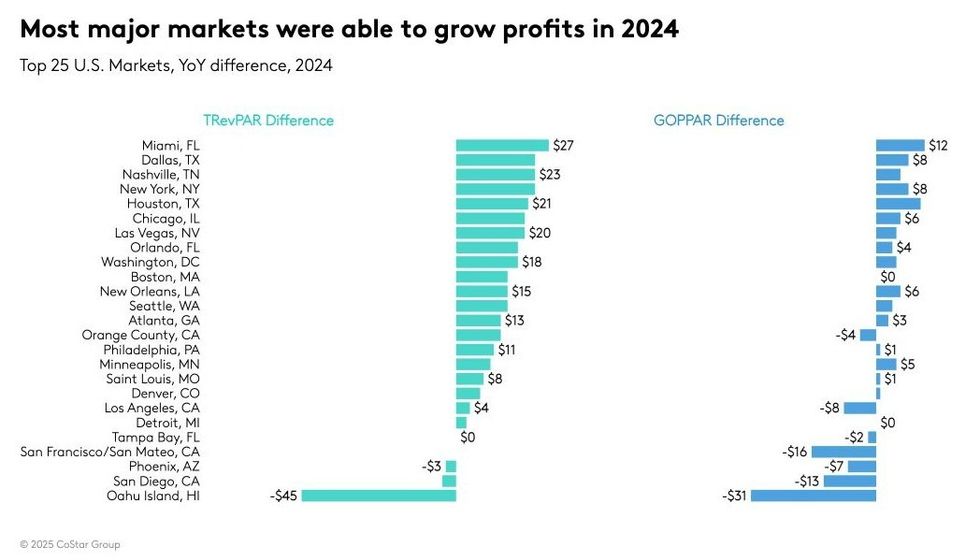

Most major markets, including Miami, Dallas, Nashville, New York, and Houston, posted profit growth, the report said.

Among the top 25 markets, Miami saw the largest gains in GOPPAR, which increased by $12, and TRevPAR, which rose by $27. Oahu experienced the largest declines in both metrics, likely due to reduced demand from labor strikes.

U.S. hotel revenues and profitability increased in 2023 compared to 2022, driven by growth in group business across the top 25 markets and upper-scale chains.