U.S. Hotel Investment Outlook 2025: Key Trends & Insights from CBRE

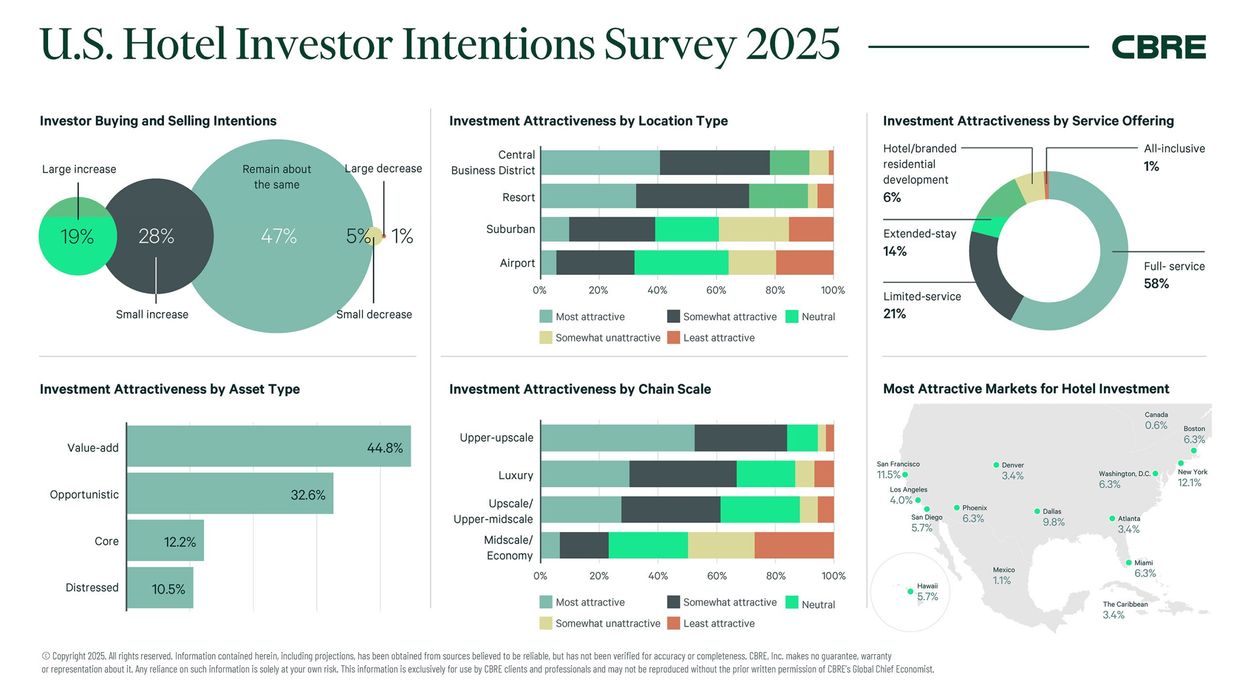

U.S. HOTEL INVESTORS are growing more optimistic, with 94 percent planning to maintain or increase investments this year, up from 85 percent last year, according to a recent CBRE study. Key drivers include improved return expectations, distressed opportunities and favorable pricing.

CBRE’s U.S. Hotels Investor Intentions Survey shows only 6 percent of investors plan to reduce allocations, down from 16 percent last year, amid slowing RevPAR growth and cost concerns.

“We anticipate an acceleration in hotel investment activity in 2025, as investors are eager to seize new buying opportunities amid increasingly favorable economic conditions,” said Bill Grice, CBRE Hotels’ president of the Americas. “With ample liquidity accessible through the debt capital markets, investors are targeting assets that offer substantial in-place cash flows and are actively seeking value-add properties that can be repositioned to yield above-market returns.”

The study also projects 2.2 percent RevPAR growth in urban markets, driven by group, business transient, and international travel. Resort RevPAR is expected to rise 1.5 percent as leisure demand normalizes with modest ADR gains.

More than three-quarters of investors favor value-add and opportunistic hotel deals, up from 72 percent last year, CBRE said. Only 11 percent target distressed assets, down from 18 percent.

Investors favor central business districts and resorts, while higher-priced chain scales are most popular, the study found. Airport and suburban assets are least preferred.

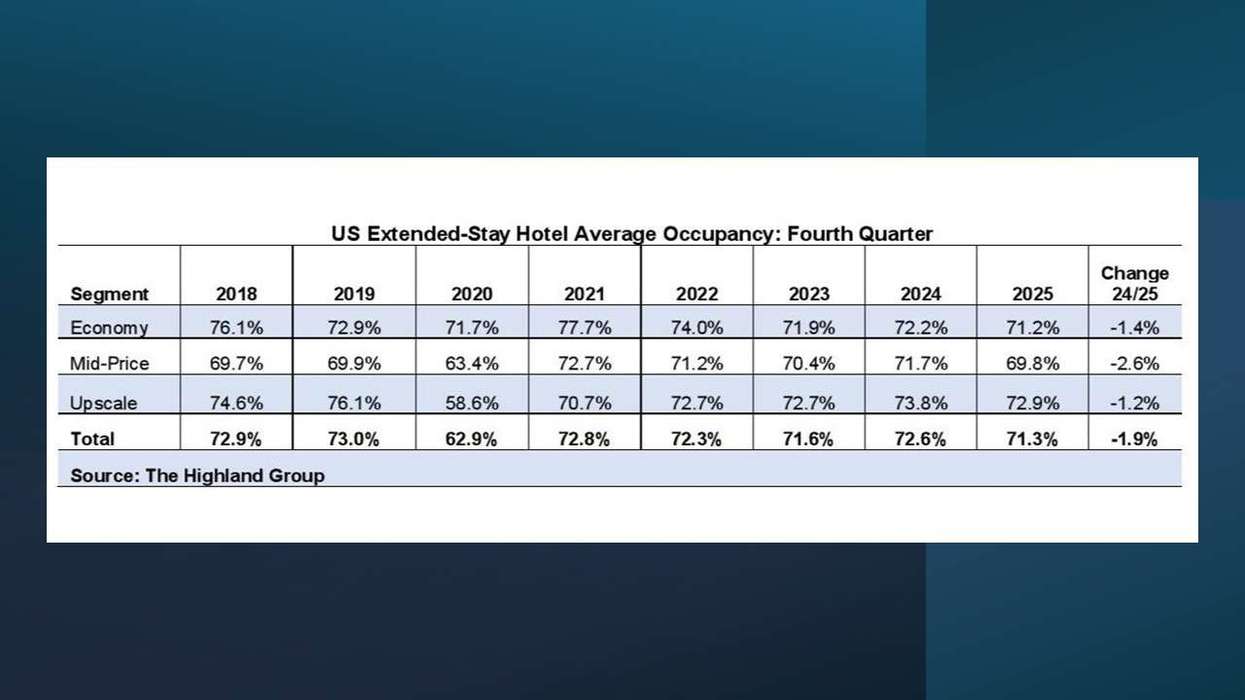

Investors favored upper-upscale hotels at 52 percent and luxury hotels at 30 percent in 2025, reflecting strong demand for high-end assets, the survey found. Full-service hotels lead at 58 percent, followed by limited service at 21 percent. Interest in extended-stay assets remains modest at 14 percent, up slightly from 13 percent, signaling a shift back to traditional properties.

New York City remains CBRE’s top hotel investment market, benefiting from limited new supply, rental restrictions, and strong demand. San Francisco ranked second, Dallas third. Interest in Washington, D.C., and Hawaii rose, while Miami cooled.

High capital and labor costs remain the top challenge for hotel investors in 2025, followed by rising renovation expenses. While alternative lodging affects demand, only 3 percent see it as their biggest concern. However, investors see a federal funds rate of 3.75 percent as key to boosting activity, aligning with CBRE’s year-end forecast of 3.5 to 3.75 percent.

In November, CBRE projected a fourth quarter rebound for U.S. hotels despite weak summer and Q3 demand. RevPAR growth for 2024 was revised to 0.5 percent from 1.2 percent due to a 40 bps occupancy drop.