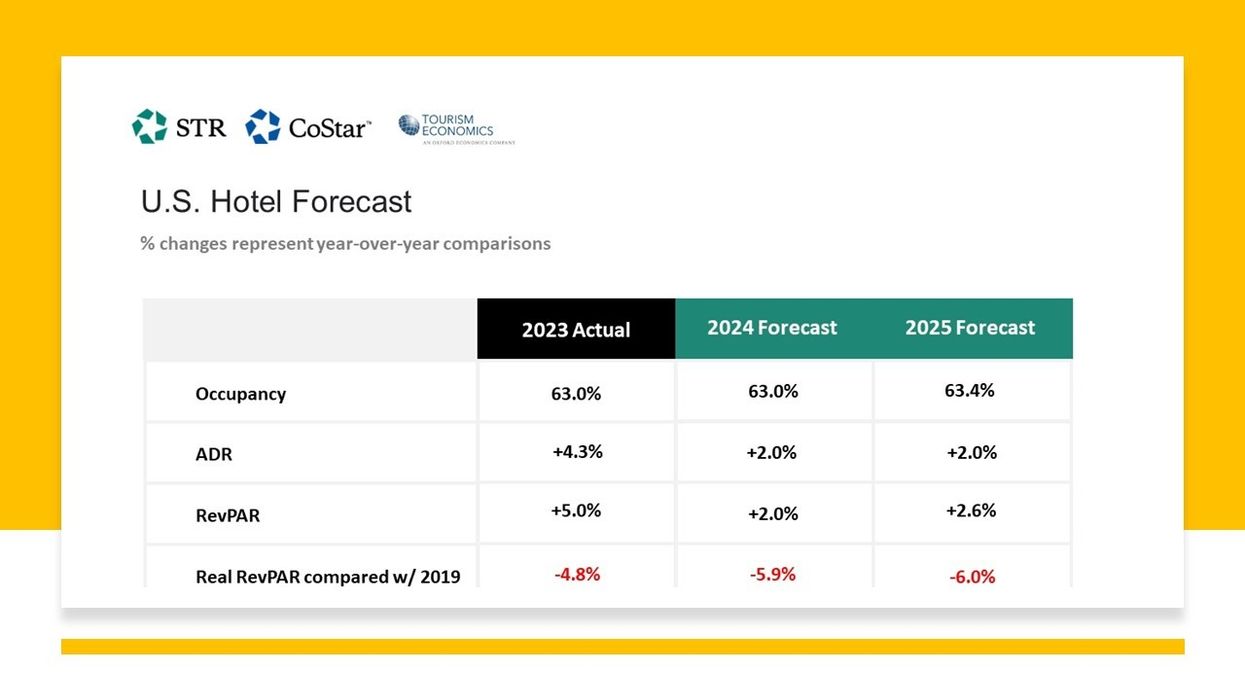

STR AND TOURISM Economics updated their 2024-25 U.S. hotel forecast, raising projected occupancy by 0.2 percentage points and revising the previous forecast of a year-over-year decline. However, ADR gains were downgraded by 0.1 percentage points, while RevPAR remained unchanged at a 2 percent year-over-year increase.

The occupancy growth projection for 2025 was also lifted by 0.2 percentage points, while ADR and RevPAR increases remained at 2 percent and 2.6 percent, respectively, STR and TE said in a joint statement.

“Midscale and economy hotels are continuing to feel the effect of fewer lower-income travelers,” said Amanda Hite, STR’s president. “On the other hand, high-income households continue to travel, but domestic levels are constrained due to an increase in outbound travel. The stronger dollar continues to pressure international inbound demand, especially as the cost-of-living crisis continues in Europe and airlift rebuilds across Asia Pacific.”

In June, STR and TE significantly downgraded the 2024-25 U.S. hotel forecast, reflecting lower-than-expected performance and reduced growth projections for the year.

“Economic growth is expected to be slower next year, but with strong household balance sheets, a gradual upswing expected in business investment, and moderating inflation, we anticipate a favorable context for moderate travel growth, said Aran Ryan, TE’s director of industry studies.

“Further gains in international inbound travel, as well as in business and group travel, are also expected to help support lodging demand growth next year.”

Hite said annual GOP and EBITDA margins are forecasted to improve slightly year over year.

“For 2025, higher growth is expected across both metrics due to lower labor costs, which are set to decrease slightly for a majority of the chain scales,” she said. “Upper midscale chains are still expected to maintain the lowest labor costs this year, with 2025 levels forecasted to come in $168 lower than luxury chains.”

In January, STR and TE projected ADR to rise by 0.1 percentage points in 2024, with occupancy and RevPAR unchanged. However, 2025 projections were revised downward, with occupancy reduced by 0.1 points, ADR by 0.3 points, and RevPAR by 0.5 points.