IN ANOTHER SIGN of recovery from the COVID-19 pandemic, this year’s Super Bowl is expected to bring increases in hotel business to host city Los Angeles, according to STR. ADR and RevPAR are projected to reach the second-highest levels for any Super Bowl weekend on record.

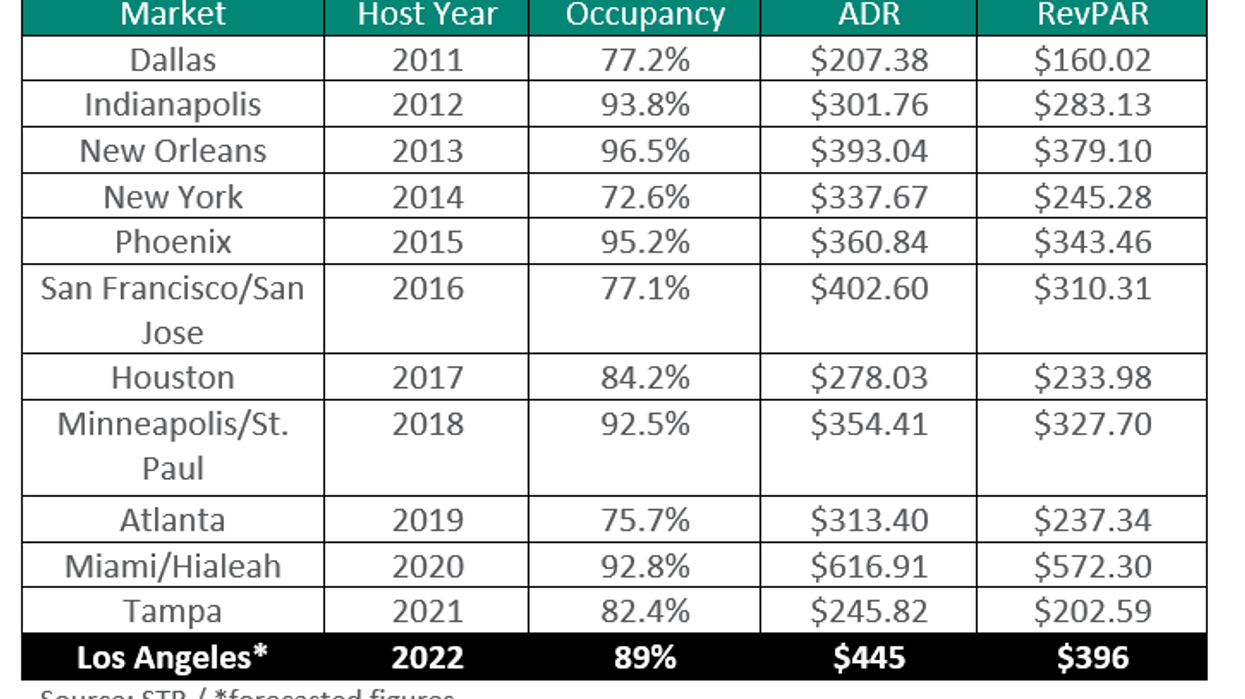

During the weekend of the game, Feb. 11 to 13, STR forecasts that ADR will reach $445 and RevPAR will be around $396 in the L.A. market. Occupancy is expected to hit 89 percent as fans flock in for the game.

“Since July, the Los Angeles hotel market has consistently achieved monthly rates near or above pre-pandemic levels,” said Blake Reiter, STR’s director of custom forecasts. “Occupancy has been rapidly improving toward 2019 levels as well, but it hasn’t reflected the same degree of recovery. We expect there will be, at least to a certain extent, a curtailing of occupancy because of COVID. Of course, if the NFL decides to switch venues as media reports have suggested, or implement more stringent protocols, L.A. hotel performance will certainly be among the ripple effects.”

Los Angeles’s Super Bowl hotel occupancy is projected to outperform last year’s venue, Tampa, Florida, which saw 82.4 percent occupancy when the home team, the Tampa Bay Buccaneers, defeated the Kansas City Chiefs. However, it is well below the 92.8 percent Miami saw when it hosted the game in 2020, and also is lower than what L.A. saw over the comparable weekend period in 2020, 87.7 percent.

Because the last time L.A. hosted the Super Bowl was 30 years ago in a completely different kind of market, STR decided to analyze performance data from game weekends in other markets, including Miami, to form its projection, Reiter said. While it is smaller, Miami has similar typical occupancy levels during February.

“We also feel that Miami, in particular the luxury segment, carries similar rate upside for VIP travelers,” Reiter said.

He also said STR expects less impact from the pandemic.

“While we are still in the midst of the pandemic, we don’t anticipate the same degree of COVID impact that we saw in 2021,” Reiter said. “Last year, we did not see the typical two-week lead-up to the game when occupancy begins to tick upwards as production crews, NFL personnel, and game attendees arrive. This year, we are expecting a more substantial level of demand capture ahead of the game. While the lead-up demand won’t be as significant as we would’ve otherwise expected during a non-pandemic year, we can certainly expect an increase compared to what was seen in Tampa.”