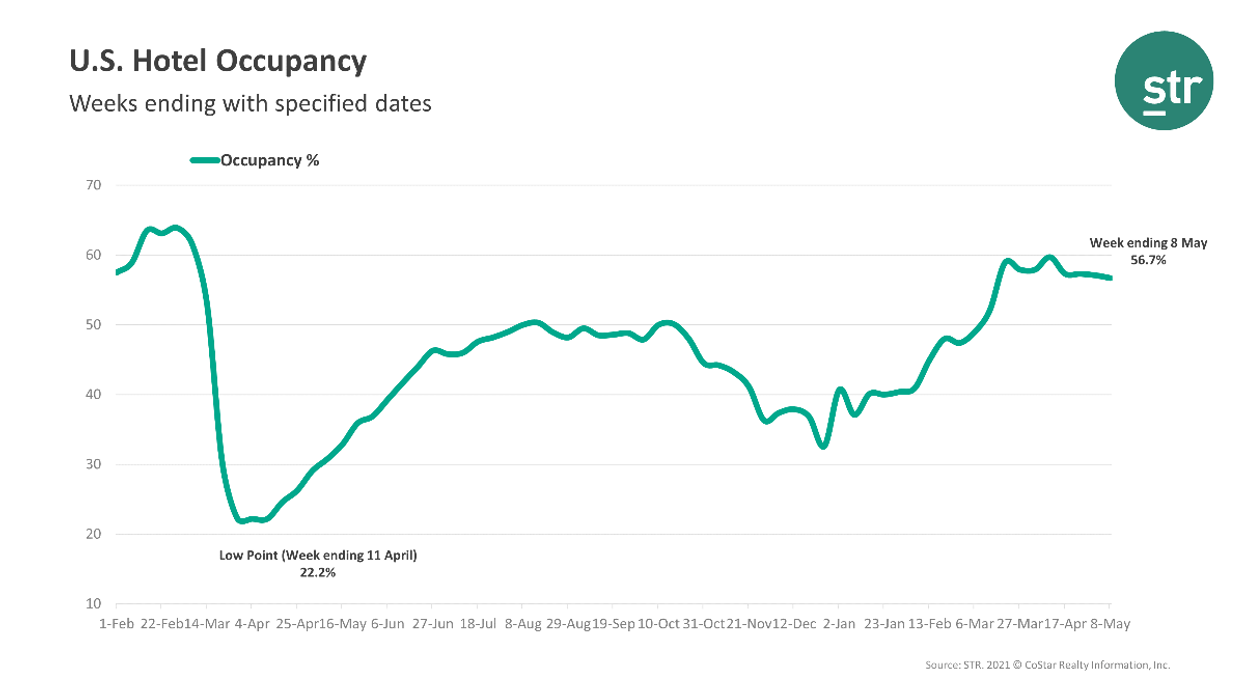

A RISE IN supply led to a slight week-over-week decline in U.S. hotel performance during the first full week of May. Demand was still rising, however.

Occupancy was 56.7 percent for the week ending May 8, down from 57.1 percent the week before. ADR for the week was $110.19, up from $108.80 the week before, and RevPAR rose to $62.50 from $62.13.

“Demand was up week over week, but an increase in supply from both reopenings and new properties pulled national occupancy down,” STR said. “Major markets, such as New York City and San Francisco, are showing the most movement with properties coming back online.”

STR’s top markets together saw 54.3 percent occupancy, lower than the national average, and ADR was higher than the average at $119.14. The highest occupancy rates were in Miami with 72 percent and Tampa with 69.8 percent. The lowest occupancy was in San Francisco and San Mateo, California, with 40.9 percent and Boston with 42.3 percent.