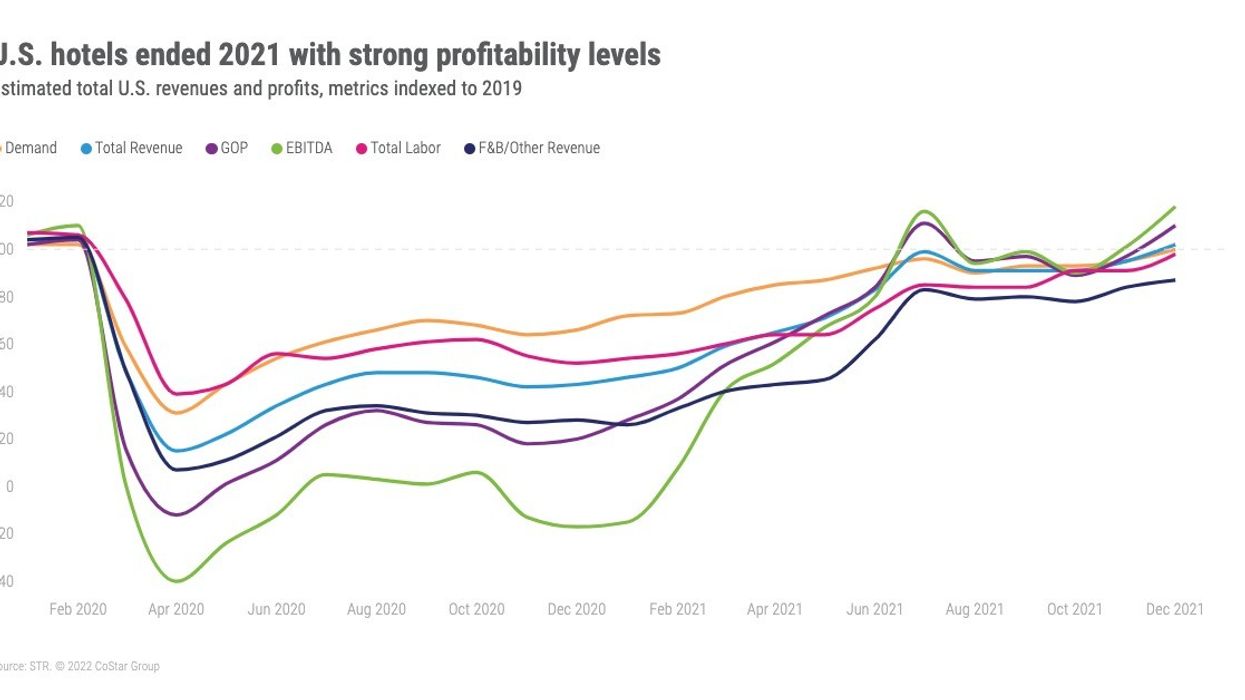

IN 2021, GOPPAR for U.S. hotels reached 52 percent of the comparable 2019 level, according to STR‘s full-year 2021 P&L data release. The holiday period was particularly profitable last year.

GOPPAR for the year was $40.48, TRevPAR was $124.36 and EBITDA PAR was $23.96. Labor costs were $41.82.

November and December saw strong holiday demand that helped overall profitability levels, with December showing 2021’s highest recovery index in each of the key metrics. GOPPAR was $46.98 for that month, TRevPAR was $154.50, EBITDA PAR was $29.76 and labor cost was $56.30. In November, GOPPAR was $50.07 for that month, TRevPAR was $153.74, EBITDA PAR was $34.55 and labor was $53.55.

October also was a strong month, with GOPPAR at $62.75, up from $46.29 in September. TRevPAR for the month was $165.03, compared to $140.94 the month before, and EBITDA PAR was $44.14, up from $30.47 in September. At the same time, labor costs also rose from $47.50 the previous month to $52.17 in October.

“Though the industry still has a way to go on the path to full recovery, a lot of headway was made in 2021,” said Raquel Ortiz, STR’s assistant director of financial performance. “Each passing month we saw revenues and profits continue on a positive, upward trend. Profit margins were relatively strong throughout the year, remaining close to pre-pandemic levels. Better margins largely stemmed from lower expenses, due to lower demand and a lack of groups and meetings, while other lifts came from cuts in room service, more online customer service, and lower employment levels. Labor costs, which were a large concern even before the pandemic, will continue to put pressure on the bottom line.”

All major markets saw positive GOPPAR for the year, particularly beach destinations such as Miami and Tampa. Markets that rely heavily on business demand, such as San Francisco/San Mateo, still have more ground to cover in terms of reaching pre-pandemic GOPPAR and TrevPAR levels.