TOTAL EXTENDED-STAY HOTELS achieved new fourth-quarter milestones in 2023, setting records in supply, demand, ADR, RevPAR, and room revenues, according to The Highland Group. Despite this, occupancy declined alongside the broader hotel industry trend, with slower growth in ADR and RevPAR throughout the year. Consequently, extended-stay hotel RevPAR experienced its smallest fourth quarter increase since 2019, excluding contractionary periods.

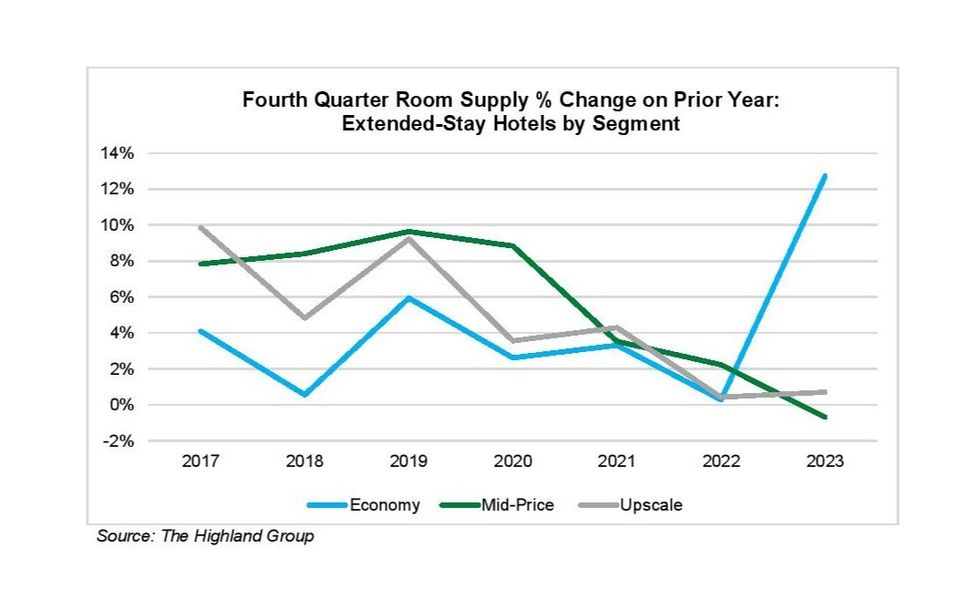

Extended-stay hotel supply growth increased marginally in 2023 but remained very low, the report said. The last time supply growth consistently hovered around its current level was from the fourth quarter of 2010 through the third quarter of 2014. Throughout this period, supply increases stayed below their long-term historical average for 20 consecutive quarters, while the federal funds rate was about 10 times higher than its current level.

With interest rates and construction costs expected to stay relatively high, the risk of extended stay hotel oversupply nationally is low in the near term, despite the launch of several new brands, The Highland Group said.

Fourth quarter highlights for extended-stay hotels include:

- Lowest occupancy in a decade

- Second lowest net gain in new rooms in ten years

- Record-high revenues across all segments

- Room revenues up 3.3 percent compared to the previous year

- RevPAR increased by 1 percent compared to fourth quarter of 2022

- Average occupancy 12 points higher than all hotels

Supply dynamics in Q4

The 13 percent rise in economy extended-stay supply, coupled with a decrease in mid-price segment rooms, is primarily attributed to conversions, the report added. New construction in the economy segment is estimated to account for approximately 3 percent of open rooms compared to the previous year.

Supply change comparisons have been influenced by re-branding, which entails moving rooms between segments in The Highland Group’s database, as well as the de-flagging of hotels that no longer meet brand standards. Moreover, some hotels have been sold to multi-family apartment companies and municipalities, further impacting the comparison, the report added.

This pattern is likely to continue into the first half of 2024 as several older extended-stay hotels remain on the market. However, the total year-over-year increase in extended-stay supply compared to 2022 is expected to remain well below the long-term average.

Demand up in economy, upscale segments

The economy and upscale extended-stay hotel segments saw record-high demand in the fourth quarter of 2023, the report said. However, demand in the mid-price segment dropped by 2 percent compared to the fourth quarterof 2022. The mid-price segment's supply contraction due to re-branding negatively impacted demand while boosting it in the economy segment.

Total extended-stay hotel demand increased by 1.2 percent, a favorable contrast to the 0.6 percent decline reported by STR/CoStar for the overall hotel industry in the fourth quarter.

The rate of room revenue increase has declined since the significant gains observed after 2020. While fourth quarter 2023 growth resembled that of the third quarter, the total revenue increase for the fourth quarter marked the smallest percentage change in total extended-stay hotel revenue over the past 20 years, excluding contractionary periods.

Nevertheless, it surpassed the 2.4 percent increase estimated by STR/CoStar for the overall hotel industry, the report added.

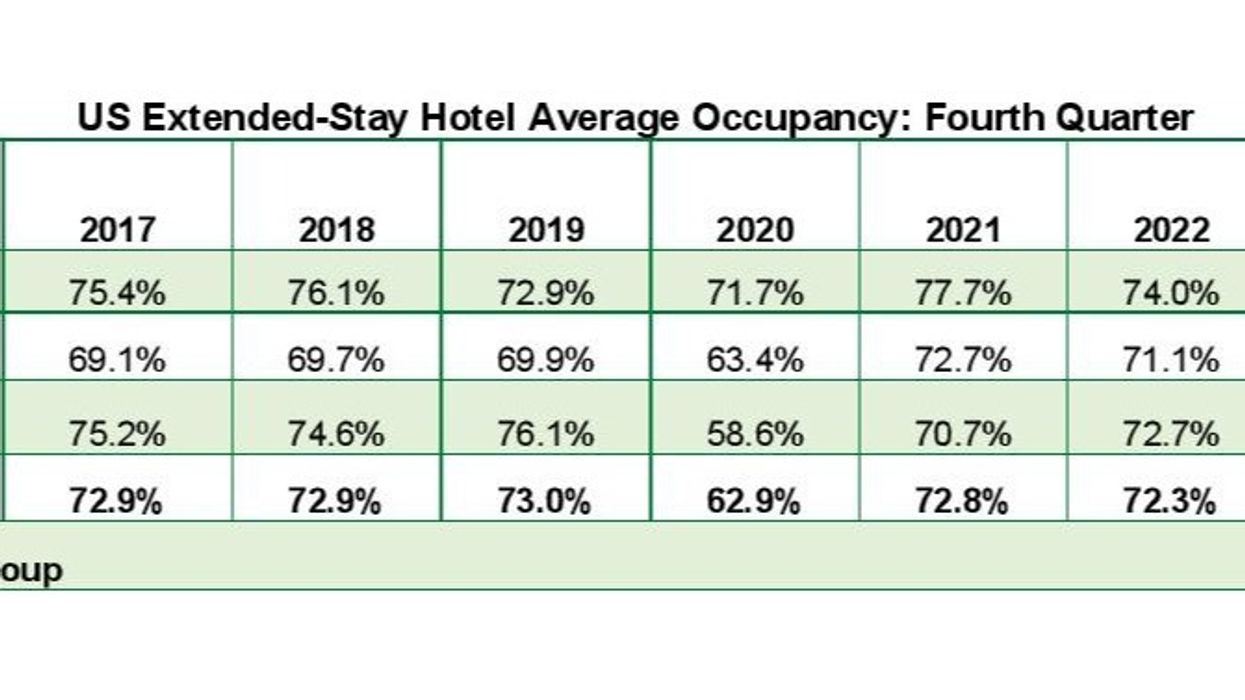

Occupancy dips

In the fourth quarter, all three extended-stay segments witnessed a decline in occupancy for the first time in three years, marking the third consecutive quarter with lower total extended-stay occupancy compared to 2022, The Highland Group said. All three extended-stay segments achieved record-high ADR in the fourth quarter of 2023. Mid-price was the only segment to report a stronger ADR increase compared to the overall hotel industry in the fourth quarter.

Economy extended-stay hotels faced their third successive quarterly decline in RevPAR in the fourth quarter, although the drop was less than in the previous two quarters and notably lower than the 5.2 percent decrease STR/CoStar reported for all economy class hotels. Mid-price and upscale extended-stay hotels similarly reported their lowest quarterly RevPAR gain of the year in the fourth quarter.

Extended-stay hotels' occupancy premium above the overall hotel industry averaged about 11 percent from 2016 through 2019, following a typical pattern over the last 25 years, The Highland Group added. This premium tends to rise during contractionary periods and widened substantially during the pandemic-induced downturn, peaking at 21 percent in the fourth quarter of 2020.

At 12.3 percentage points in the fourth quarter of 2023, the premium remains unchanged from a year ago and about one point higher than in the fourth quarters from 2016 through 2019.

ADR, RevPAR growth

The Highland Group report further indicated that extended-stay hotels increased ADR slightly faster than the overall hotel industry from 2016 through 2019. Relative growth accelerated in 2020, with the ratio peaking at 88 percent before declining to 76 percent to 78 percent over the past two years as the overall hotel industry recovered ADR more quickly due to much deeper losses during the pandemic. In the fourth quarter of 2023, the ratio of extended-stay hotel ADR to overall hotel industry ADR was about two points lower than in 2016.

Relative RevPAR followed a similar trajectory, accelerating gains from 2016 through 2019 and peaking at a ratio of 132 percent in the fourth quarter of 2020. As the overall hotel industry recovered RevPAR more quickly, the extended-stay hotel’s RevPAR ratio declined to 91.4 percent in the fourth quarter of 2023, approximately the same as in the fourth quarter of 2016.

Economy extended-stay hotels show one of the highest RevPAR recovery ratios in the hotel industry, reaching 121 percent compared to fourth quarter of 2019. Leading the recovery, these hotels were the first to report a full annual RevPAR rebound in 2021. Despite a decline in RevPAR over the last year, economy extended-stay hotels achieved significant gains compared to economy hotels overall.

Mid-price extended-stay hotels swiftly returned to their pre-pandemic RevPAR level, remaining one of the hotel industry’s strongest performing segments. They also made gains compared to all mid-price hotels. In the fourth quarter of 2019, the ratio of mid-price extended-stay hotel RevPAR to all mid-price hotel RevPAR was 97 percent. Four years later, despite higher supply growth over the period, it increased to 107 percent.

Due to a higher concentration of rooms in urban sub-markets, upscale extended-stay hotels have been slower to recover compared to the overall extended-stay segment. Despite being fully recovered for over a year, the segment has experienced a decline in RevPAR relative to all upscale hotels since 2019.

Extended-stay hotels showed diverse performance compared to the overall hotel industry in December, with gains in supply, demand, and room revenues, according to The Highland Group.