MOST PERFORMANCE METRICS for extended-stay hotels in January trailed behind the overall hotel industry compared to the same month last year, according to The Highland Group.

Weather likely influenced this, particularly due to the construction industry's significant contribution to extended-stay hotel demand, especially at lower price points.

According to the National Centers for Environmental Information, January witnessed geographically widespread record low temperatures in 2,500 counties. Additionally, there was large-scale flooding in Texas and Louisiana, marking it as the tenth wettest January on record.

Extended-stay hotels have maintained strong annual demand over the past 25 years, excluding 2020, with rare monthly contractions during this period, the report said.

Room supply downturn

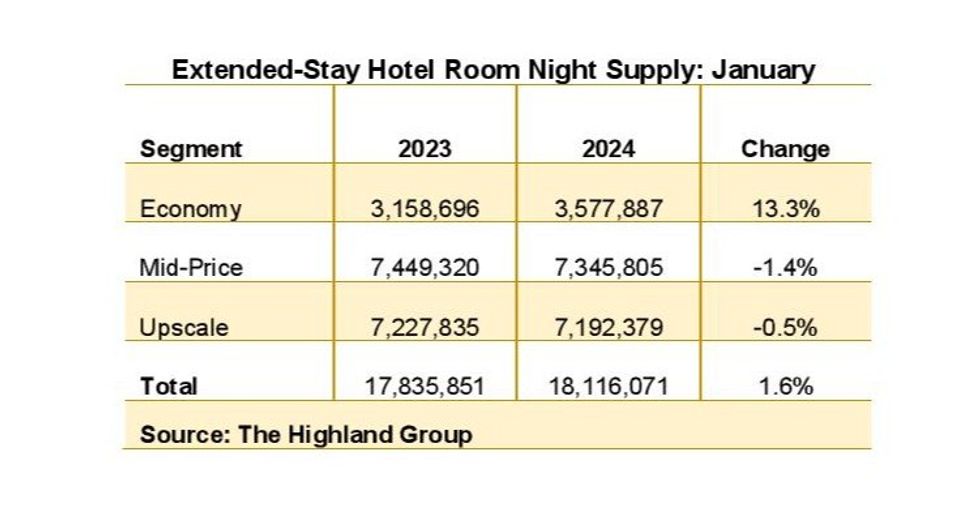

The 1.6 percent net increase in extended-stay room supply in January represents a decrease compared to the two-year average, the report said. January marked the 28th consecutive month of 4 percent or less supply growth. Over the past two years, the change in supply has remained below 2 percent, with both metrics significantly lower than the long-term average.

The 13.3 percent increase in economy extended-stay supply and decline in mid-price segment rooms are mainly due to conversions, with new construction in the economy segment estimated at about 3 percent of rooms open compared to one year ago.

Supply change comparisons have been influenced by re-branding, room movements between segments in our database, de-flagging of hotels failing to meet brand standards, and the sale of some hotels to multi-family apartment companies and municipalities.

This trend is expected to persist in the first half of 2024, as several older extended-stay hotels are still on the market, the report said. However, the overall year-on-year increase in total extended-stay supply compared to 2023 will remain notably below the long-term average."

Decrease in revenue

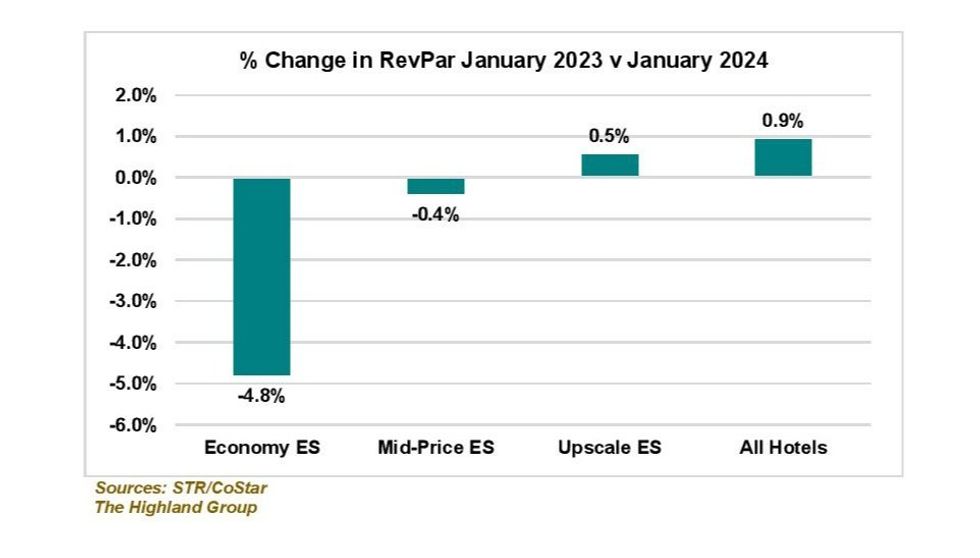

The re-branding related supply contraction in the mid-price segment had the most significant negative impact on segment demand. Despite the economy segment's gains, total extended-stay demand saw its first monthly decline in over a year, slightly exceeding the 0.7 percent decrease estimated by STR/CoStar for the overall hotel industry.

The report noted that in January, economy extended-stay hotels experienced their first monthly drop in ADR since November 2020. Despite this, gains in the mid-price and upscale segments lifted total extended-stay hotel ADR by 1 percent compared to January 2023. However, this increase in total extended-stay ADR fell short of the 2.6 percent growth reported by STR/CoStar for the overall hotel industry.

Only the extended-stay upscale segment observed a rise in RevPAR in January, the report said. On the other hand, the mid-price segment saw its first monthly decline in RevPAR in almost three years. Although January marked the economy segment's tenth consecutive monthly decline in RevPAR, it was less severe than the 6.1 percent contraction estimated by STR/CoStar for all economy class hotels.

The Highland Group recently said that extended-stay hotel occupancy decreased across 59 MSAs in 2023 compared to 2019, attributed to substantial ADR growth over the past three years.