U.S. EXTENDED-STAY HOTELS showed positive growth in April after a difficult first quarter, according to The Highland Group. Monthly room revenue growth was the highest in nearly a year, demand saw its strongest increase in 16 months, and ADR and RevPAR turned positive after two and four months of decline, respectively.

“The performance of extended-stay hotels in April re-established the segment’s long-term trend of increasing its market share of total hotel supply, demand and room revenues,” said Mark Skinner, partner at The Highland Group.

The extended-stay room supply grew 2.8 percent in April, slightly above the average monthly increase over the last two years, the report said. However, April marked 31 consecutive months of 4 percent or less supply growth, with annual supply change under 2 percent for two years—both metrics well below the long-term average.

The Highland Group reported a 13.8 percent increase in economy extended-stay supply and a small gain in mid-price segment rooms, mainly due to conversions. New construction in the economy segment is estimated at about 3 percent of rooms open compared to a year ago.

Supply change comparisons have been affected by rebranding that shifts rooms between segments in The Highland’s database, de-flagging of hotels that no longer meet brand standards, and sales of hotels to multi-family apartment companies and municipalities.

Meanwhile, The Highland Group expects this trend to continue at least through the first half of 2024, as several older extended-stay hotels are still on the market. However, the annual increase in total extended-stay supply compared to 2023 will remain well below the long-term average.

Extended-stay hotel revenues rebounded strongly in April with a 5.5 percent gain, the highest monthly increase since May 2023, the report said. This exceeded the 3.1 percent increase reported by STR/CoStar for the overall hotel industry.

Total extended-stay demand increased by 4.5 percent in April, marking positive growth in 16 of the last 17 months, The Highland Group said. Excluding the leap year boost in February 2024, April's demand increase was the strongest since January 2023 and outpaced the 2.3 percent growth reported by STR/CoStar for the overall hotel industry.

Key metrics recovery and growth

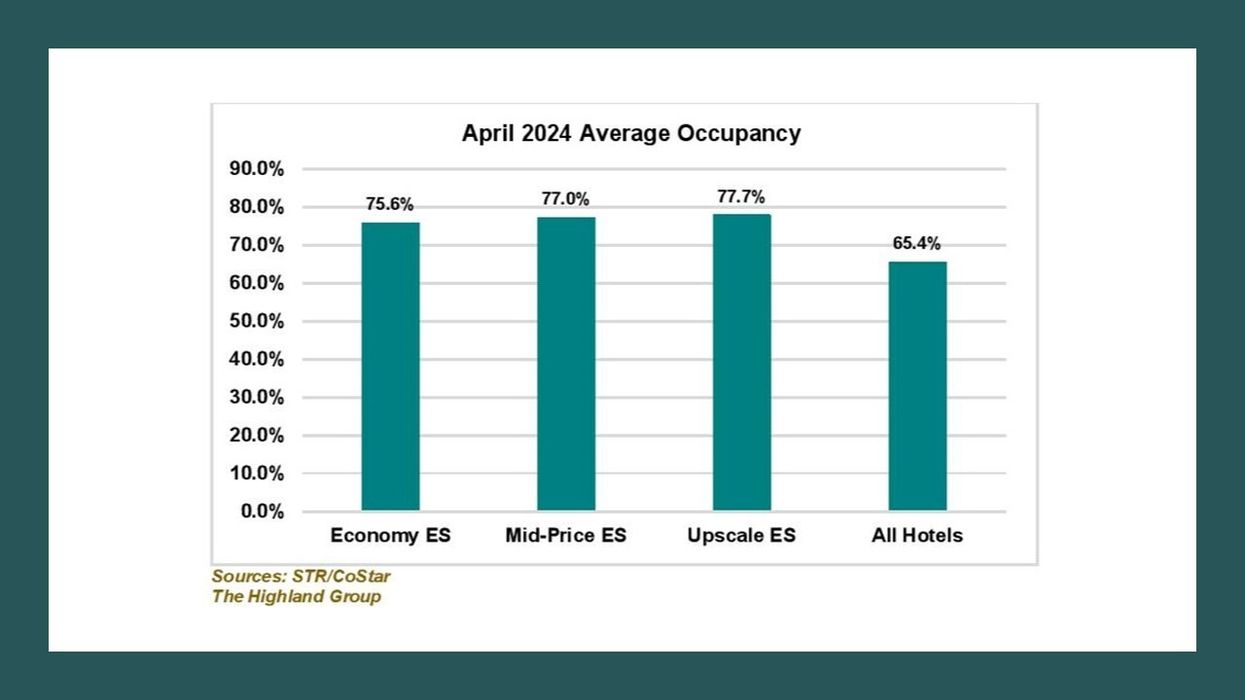

April saw the first monthly increase in extended-stay hotel occupancy in over a year, surpassing the overall industry's 1.3 percent gain reported by STR/CoStar, The Highland Group said. Extended-stay hotel occupancy was 11.6 percentage points higher than the total hotel industry, aligning with the historical long-term average occupancy premium.

After two consecutive monthly declines—the first in three years—extended-stay hotel ADR increased in April, with the economy segment's fractional decline being the smallest since January, the report said. Compared to similar hotel classes, economy and mid-price extended-stay ADR performed better in April. However, the upscale extended-stay segment's 1.4 percent gain slightly lagged behind the 1.6 percent increase reported by STR/CoStar for all upscale class hotels.

Extended-stay hotels saw a reversal in the four-month trend of declining monthly RevPAR, with a 2.6 percent gain in April, outperforming the 2 percent increase estimated by STR/CoStar for all hotels during the same period, The Highland Group said. The consistent monthly RevPAR declines in economy extended-stay hotels began a year ago.

However, April's 0.8 percent contraction was the second lowest over this period, significantly less than the 3.6 percent fall reported by STR/CoStar for all economy class hotels.

In early May, The Highland Group reported that U.S. extended-stay hotels faced a 1.6 percent RevPAR decline in the first quarter of 2024, despite a 1.5 percent revenue increase. Demand rose by 1.7 percent, contrasting with a 2.8 percent drop in total hotel demand when excluding upper upscale and luxury segments.