PEACHTREE GROUP RECENTLY issued a $40-million retroactive Commercial Property Assessed Clean Energy loan to BLG San Diego LLC for the newly opened 147-room AC Hotel San Diego Downtown Gaslamp Quarter. The proceeds enabled BLG to reduce its senior loan with California-based Preferred Bank and E.Sun Commercial Bank to under $20 million, thereby mitigating the banks’ exposure, Peachtree said in a statement.

“This innovative capital structure significantly alleviated the immediate financial pressures, enabling the hotel to establish a solid cash flow foundation during its initial years of operation,” said Greg Friedman, managing principal and CEO, Peachtree Group.

Peachtree is led by Friedman, with Jatin Desai as managing principal and chief financial officer, and Mitul Patel as principal.

The CPACE financing is amortized over more than 30 years, with no payments required for the first year, followed by five years of interest-only payments.

“When we opened the AC Hotel San Diego Downtown Gaslamp Quarter in March 2023, there was a sizeable disconnect between hospitality fundamentals, which are strong, particularly in San Diego, while the debt markets were deteriorating meaningfully,” said Brad Honigfeld, the New Jersey-based Briad Group’s founder, chairman and co-CEO. “The Fed’s tightening process and rising fund rates drove up the cost of debt considerably.”

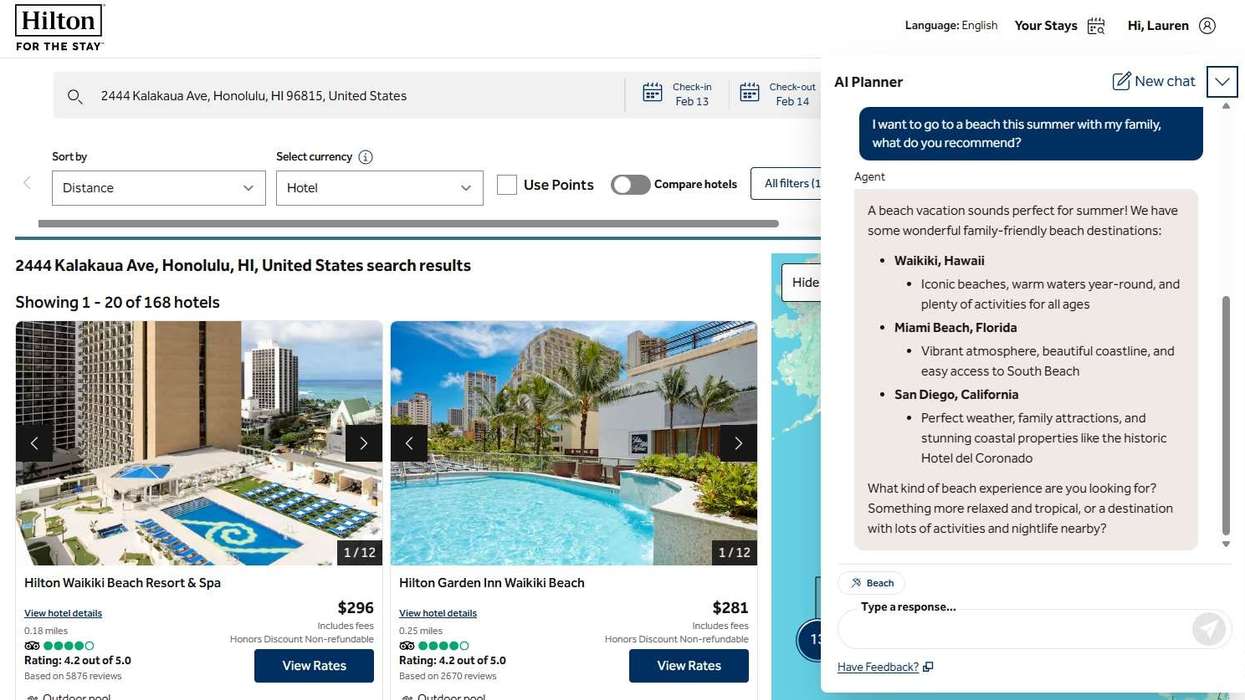

The new hotel is in downtown San Diego’s Gaslamp Quarter, known for its restaurants, shops and nightlife.

“Our hotel was benefiting from its location and performing to its original underwriting, but the debt costs were straining cash flows,” Honigfeld said.

Retroactive CPACE funding provides advantages for property owners, Peachtree said. It operates like standard pre-project funding but 100 percent of the loan proceeds can reimburse owners for previously incurred costs. This allows for better loan terms and improved cash flow after project completion.

“The financial relief it provides not only ensures the hotel’s success but also positions it for long-term stability,” said Friedman. “By reducing the financial burden in the early years, owners can focus on delivering exceptional guest experiences and achieving operational excellence.”

By 2024, $5.8 billion in U.S. hotel-securitized loans will need repayment, refinancing, extension, or sale, according to Peachtree, citing JLL Research. In this tough lending market, CPACE financing has become a liquidity source as owners face upcoming debt maturities and limited refinancing options. It has quickly gained traction in commercial real estate, reaching $7.2 billion in the U.S. in just over a decade, according to PACENation.

In December, Peachtree Group secured $150 million in commercial PACE financing, bringing its total to nearly $750 million since 2019. The company completed 23 CPACE financing deals in the U.S. in 2023, totaling $250 million in directly originated and balance-sheet-funded transactions.