THERE’S A QUESTION hoteliers in the current economic climate have to ask themselves, according to a blog article from Hotstats: How low can you go? It’s a matter of balancing the cost of operating, or not operating, versus the revenue they stand to make to determine the break-even point.

The way to find that balance is a specific analysis, according to the article by David Eisen, Hotstats’ director of hotel intelligence and customer solutions, and Laura Resco, sales and account coordinator. The idea is that even a closed hotel incurs cost in terms of debt service, property taxes, utilities and even some labor costs. A break-even analysis determines the level of occupancy required for a property to operate at neither a loss nor gain.

The Hotstats article includes an interview with Imesh Vaidya, CEO of Premier Hospitality in Albuquerque, New Mexico. Premier Hospitality recently added a SpringHill Suites by Marriott in Durango, Colorado, to its portfolio of nine select-service hotels.

The company opened the new hotel at the end of April to reduce its losses from $6,000 per day or $5,800 per day, Vaidya is quoted as saying. The break-even analysis was a deciding factor in Premier’s decision to buy the property.

“It helps determine how we staff, our purchasing decisions—it's used for all aspects of the property," Vaidya said.

While hotels responded to previous downturns by lowering rates, Vaidya said that stimulating demand is not his concern even after travel restrictions are eased. He is more concerned with the costs associated with the extra cleaning that will be required when guests start coming again.

"Payroll will increase for extra time spent on rooms and public spaces and paying someone to wipe elevators and the pool down," he said.

For example, lobby areas in the new SpringHill are wiped down on the hour and cleaning rooms takes an extra 10 minutes each.

"That's an extra 10 minutes per room not budgeted for," Vaidya said, "Cleaning supplies are adding $1,200 in cost per month."

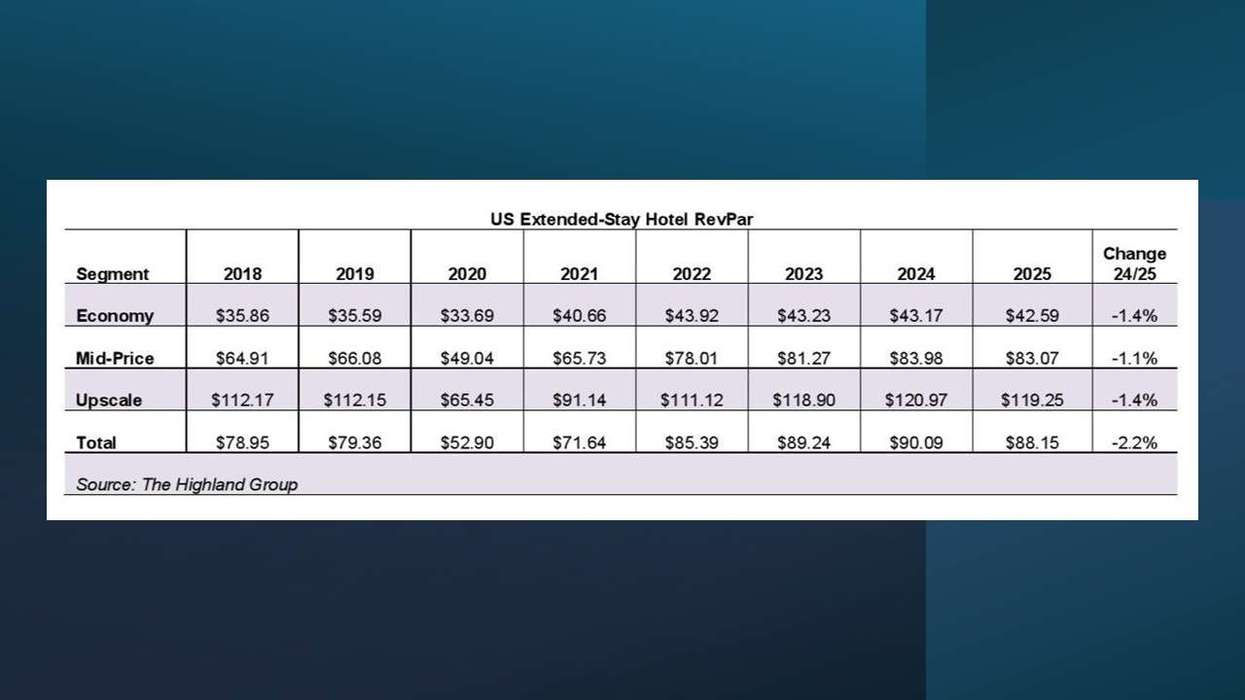

The break-even point in occupancy varies according to chain-scale segment, Eisen and Resco wrote, with a higher occupancy rate needed at lower levels on the scale. In the U.S., for example, the break-even rate for luxury hotels is 34.4 percent while select-service hotels, such as Vaidya’s, require 39.4 percent occupancy.

“The explanation for that tendency rests in the variance between asset classes,” the article said. “The break-even occupancy for the total U.S. to achieve a zero gain or loss in profit is 37.3 percent. The model is further refined by calculating the break-even point for each asset class separately, as a way of minimizing the average room rate variance of the total sample.”

In the end, Eisen and Resco conclude that the pandemic will permanently alter the hotel industry.

“After years and quarters of positive profit gain for hotels, COVID-19 has forced hoteliers to think differently and consider break-even modeling,” the article said. “Running a hotel that loses money is not a viable business model and with occupancy globally taking a hit, it is incumbent on hoteliers to consider what occupancy rate will allow a hotel to sustain operations. The sooner the better and with the hope that the break-even occupancy rate is only a short-term necessity.”

In April, Hotstats reported that in March hotels in the U.S. saw profits drop more than 100 percent from the previous year.