ALL MAJOR PUBLICLY traded hotel companies listed in the earnings charts listed below pulled their RevPAR and financial guidance for 2020 in March as the new-coronavirus pandemic all but halted non-essential travel in the U.S. and around the world. Some companies announced other actions to ease financial losses.

On March 18, Arne Sorenson, president and CEO of Marriott International, said in a statement the new coronavirus pandemic has caused a “complex and unprecedented” crisis in the global hospitality industry. He said he expected the crisis to get worse before it gets better.

Sorenson was one of several CEOs who met with President Trump on March 17 to discuss the crisis.

To mitigate its financial losses and to preserve at least $140 million in cash, Sorenson said, Marriott planned to lay off employees at its owned and leased properties and in corporate levels. It employs 175,000 around the world.

The company owns or leases more than 2,100 properties around the world. Plans are to temporarily close the hotels’ retail F&B outlets, close off floors to reduce needed staff and in some cases close hotels.

Both Sorenson and J.W. “Bill” Marriott, executive chairman and chairman of the board, reduced their salaries to zero. Sorenson’s annual base salary is $1.3 million. Marriott’s total compensation is $3.2 million. Senior executives will see their salaries cut by half.

As for Marriott International’s more than 5,200 franchisees, Sorenson said routine mandated PIPs that were due this year have been extended into 2021. The company has also deferred required funding of FF&E by six months and has temporarily halted brand audits.

“Owners are responsible for maintaining adequate levels of working capital,” he said. “We are focused on easing their burden as together we manage through this crisis.”

During a March 19 call with analysts, Sorenson said, the company will help owners evaluate if they need to close their hotels. Many are deciding their own courses of action. He said owners and the franchiser are in “uncharted territory.”

Hilton moves to save cash

With travel at a virtual standstill, Hilton suspended operations at many managed and franchised hotels, Hilton announced on March 26. Hotels that remained open had reduced services for guests because of decreased occupancy levels.

At the corporate level, Hilton’s President and CEO, Christopher Nassetta, will forgo his salary for the remainder of 2020. His annual base salary is $1.25 million.

The executive team will take a pay cut of 50 percent to reduce losses.

Beginning April 4, Hilton will cut hours of corporate employees, reducing their pay by 20 percent. It also will furlough workers up to 90 days.

Hilton is working with large retailers such as Amazon, Walmart, Albertsons, CVS and Walgreens to connect laid off workers with 500,000 temporary jobs.

Since the new coronavirus began to spread in China, Hilton employees are donating points (converted to cash) and cash to the company’s Team Member Assistance fund to help co-workers who have contracted COVID-19 or have a family member directly affected.

Hyatt Hotels responds

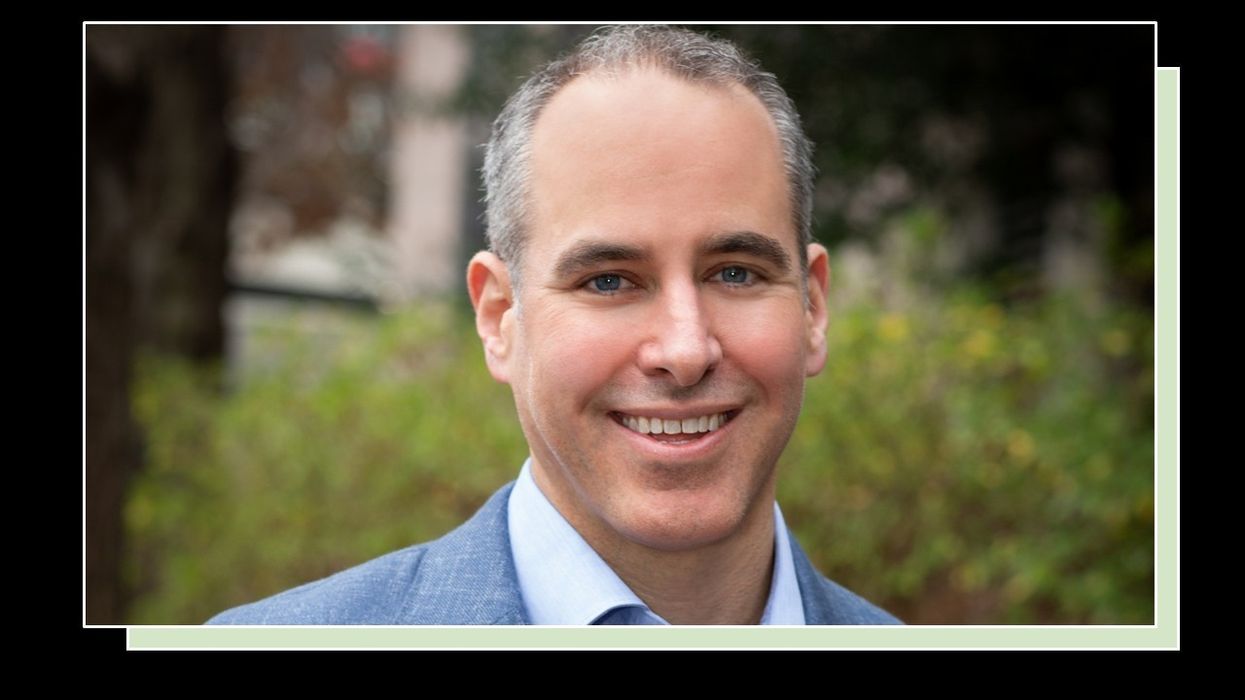

Hyatt Hotels Corp. on March 24 announced that beginning on April 1 it will lay off or cut the hours of two-thirds of its corporate employees. The program to mitigate losses will continue through May 31.

President and CEO Mark Hoplamazian and Chairman Tom Pritzker will not collect their salaries in April and May to avoid more losses. Hoplamazian’s annual base salary is $1.2 million. Pritzker’s annual base salary is $562,000. Other senior executives will see their pay cut in half. The money saved will go toward helping furloughed workers.

The following are earnings charts for Marriott International, Hilton, Choice Hotels International and Wyndham Hotels & Resorts for 2018 and 2019.

| MARRIOTT INTERNATIONAL Inc. | |||||||

| 2019 | 2018 | % change | 4Q19 | 4Q18 | % change | ||

| Properties | 7,349* | 6,755 | 8.8 | ||||

| Rooms | 1,380,921 | 1,296,172 | 6.5 | ||||

| Total revenue | $21B | $20.7B | 1 | $5.4B | $5.3B | 2 | |

| Franchise fee revenue | $2B* | $1.8B | 8 | $500M | $455M | 10 | |

| Net income | $1.3B | $1.9B | -33 | $279M | $317M | -12 | |

*Notes

| |||||||

| HILTON WORLDWIDE HOLDINGS | ||||||||||||||

| 2019 | 2018 | % change | 4Q19 | 4Q18 | % change | |||||||||

| Properties | 6,110* | 5,685 | 7.4 | |||||||||||

| Rooms | 971,780 | 912,960 | 6.4 | |||||||||||

| Total revenue | $9.5B | $8.9B | 6.1 | $2.4B | $2.3B | 3.5 | ||||||||

| Franchise fee revenue | $1.7B | $1.5B | 9.9 | $412M | $388M | 5 | ||||||||

| Net income | $886M | $769M | 15.2 | $176M | $225M | -21.8 | ||||||||

*Notes

| ||||||||||||||

| CHOICE HOTELS INTERNATIONAL Inc. | ||||||||||||||

| 2019 | 2018 | % change | 4Q19 | 4Q18 | % change | |||||||||

| Properties | 5,955 | 5,863 | 2 | |||||||||||

| Rooms | 462,973 | 450,028 | 2.8 | |||||||||||

| Total revenue | $1.1B | $1B | 7 | $268M | $245M | 9.4 | ||||||||

| Franchise* fee revenue | $371M | $360M | 3 | $87.7M | $85.8M | 2.2 | ||||||||

| Net income | $223M | $216M | 3 | $42.2M | $31.5M | 34 | ||||||||

*Notes

| ||||||||||||||

| WYNDHAM HOTELS & RESORTS Inc. | |||||||

| 2019 | 2018 | % change | 4Q19 | 4Q18 | % change | ||

| Properties | 9,280* | 9,157 | 1.3 | ||||

| Rooms | 831,025 | 809,900 | 2.6 | ||||

| Net revenue | $2B | $1.9B | 9.9 | $492M | $527M | -7 | |

| Franchise* fee revenue | $1.3B | $1.1B | 12.6 | $300M | $295M | 2 | |

| Net income | $157M | $162M | -3 | $64M | $43M | 49 | |

*Notes

| |||||||

| HYATT HOTELS Corp. | |||||||

| 2019 | 2018 | % change | 4Q19 | 4Q18 | % change | ||

| Properties | 913* | 843 | 8.4 | ||||

| Rooms | 223,111 | 208,207 | 6.9 | ||||

| Total revenue | $5B | $4.5B | 10.5 | $1.3B | $1.1B | 16 | |

| Franchise* fee revenue | $141M | $127M | 11.3 | $34M | $31M | 10.1 | |

| Net income | $766M | $769M | 0.4 | $321M | $44M | -151 | |

*Notes

| |||||||