THE COVID-19 PANDEMIC has forced Hersha Hospitality Trust to take serious measures to ensure its liquidity, including cost cuts and closings of some hotels. Other REITS, including the La Quinta Holdings spinoff CorePoint Lodging and Pebblebrook Hotel Trust, have been making similar tough choices in response to the sudden decline in hotel occupancy caused by the outbreak.

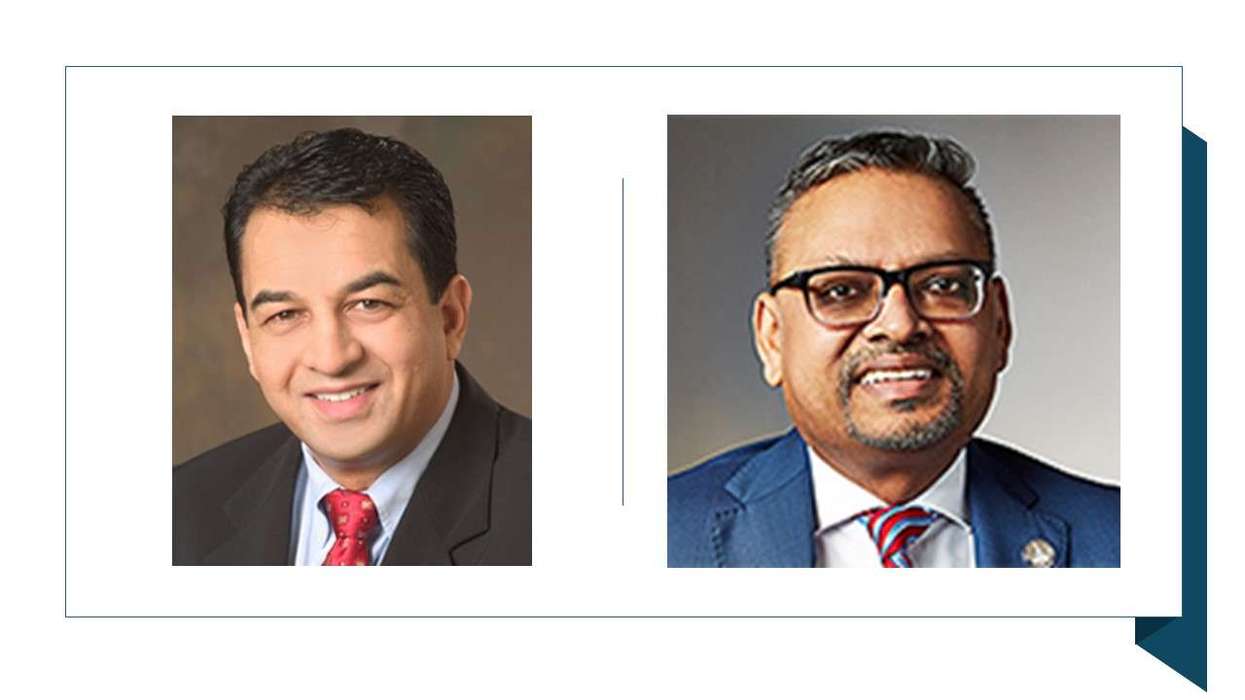

Philadelphia-based Hersha Hospitality, led by brothers Jay Shah as CEO and Neil Shah as president and chief operating officer, said in a statement that its first quarter and full year 2020 guidance released as part of its fourth-quarter 2019 earnings release could no longer be relied on as a result of the crisis.

“Since our fourth-quarter earnings call just over three weeks ago, we have experienced an unprecedented pace of transient and group cancellations across our portfolio along with a rapid and pervasive deterioration of forward booking pace related to the outbreak and spread of COVID-19. The demand shock has materially impacted the industry and our portfolio,” Jay said. “Since this situation is evolving rapidly across all markets, we are unable to provide a clear roadmap regarding the potential impact the COVID19 outbreak will have on our first-quarter and full-year results.”

Along with the cost cuts and hotel closings, the company is reducing floor operations and closing restaurants in its hotels and suspending capital expenditures planned through the end of the year, the latter of which is expected to save between $10 million and $15 million. Jay and Neil also are cutting their own salaries by 50 percent, and the company’s board of trustees will take all payment in stock in the company for the rest of 2020.

With a focus on maintaining its liquidity, the company also is considering asset sales and loans to shore up its credit, and it revoked the dividends on certain shares in the company that were announced on March 5. The board will review the company’s performance quarterly to determine when to reinstate the dividends.

"We anticipate suspending our common and preferred dividend distributions for the balance of the year, generating additional cash liquidity of approximately $72.5 million for 2020 based on last year’s distribution rates,” Jay said. “While we are adapting our operations and implementing cost reduction strategies in response to the national crisis, the company is prioritizing liquidity above all until the operating environment becomes more clear.”

Hersha Hospitality had worked through major market shocks before, Jay said, including the Sept. 11, 2001 terror attacks and the 2008 great recession.

“We expect a very difficult environment throughout 2020 and particularly across the second and third quarters, but we have faith in our healthcare system to expeditiously support the country through this trying time,” he said. “As active revenue and asset managers we are confident that the strategies we have implemented to reduce expenses and enhance our liquidity will allow us to weather this storm and ultimately lead to value creation as the country recovers from this extraordinary event.”

They will not be alone.

In its fourth quarter and full year 2019 earnings report released March 12, CorePoint reported a net loss of $154 million for that year as well as an 8.7 percent drop in RevPAR. Those losses predate the pandemic but the company, formed in 2018 after Wyndham Hotels & Resorts acquired La Quinta, withheld formal guidance for 2020.

“There has been a sudden and rapid deterioration in the macro lodging environment due to the actual and anticipated impact of the COVID-19 virus. In addition to the implementation of corporate non-essential travel bans, we have seen accelerated group cancellations and a reduction in transient demand. As a result, we believe the prudent course is to withhold formal guidance for 2020 at this time,” said Keith Cline, CorePoint’s president and CEO.

The 2019 losses are within expectations, Cline said, and the company is taking steps to improve its profitability.

“In addition to working closely with our property manager on these rapidly developing trends and cost mitigation initiatives, we also continue to support their re-establishment of revenue management and booking tools at least reasonably equivalent to the legacy systems and welcome the improvements they are making to their management team and processes,” Cline said. “We are expanding and accelerating our ongoing asset disposition strategy to focus on a core portfolio of 105 hotels located primarily in higher-growth markets. The dispositions of underperforming hotels to date have created significant value and unlocked capital which we have used primarily to pay down debt and improve our balance sheet with minimal loss of Adjusted EBITDAre. We are anticipating the second phase of our disposition program consisting of 132 additional hotels could take generally two years to complete, while generating expected gross proceeds of approximately $800 million at attractive valuations highly-accretive to our trading multiple.”

Jon Bortz, CEO for Pebblebrook, was one of several leaders of major hotel companies to who met with President Trump last week to discuss the economic impact of the COVID-19 pandemic. The REIT’s 54 hotels are in cities hit hardest by the outbreak, including Seattle, San Francisco and New York, he said.

“As of today, we have had to make the difficult decision to let go over 4,000 employees,” Bortz said. “By the end of the month, we expect another 2,000 employees will also be let go, representing over three quarters of our employees. We are looking at closing the doors at more than half of our properties. This is the reality we, and countless other owners and operators around the country are facing in the wake of this public health situation.”