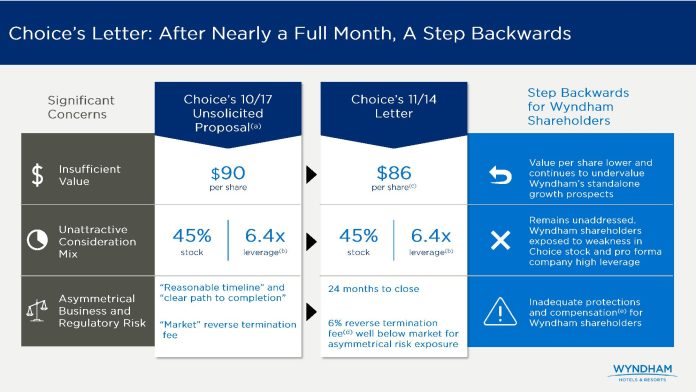

CHOICE HOTELS INTERNATIONAL is continuing its bid to acquire Wyndham Hotels & Resorts while the latter’s board of directors continues to refuse those advances. Earlier this month, Choice sent a letter to Wyndham’s board that Wyndham calls “a step backwards.”

In its original proposal, made public in October, Choice said it sought to acquire all the outstanding shares of Wyndham at a price of $90 per share and shareholders would have received $49.50 in cash and 0.324 shares of Choice common stock for each Wyndham share they own. Choice claimed that is a 26 percent premium to Wyndham’s 30-day volume-weighted average closing price ending on Oct. 16, an 11 percent premium to Wyndham’s 52-week high, and a 30 percent premium to Wyndham’s latest closing price.

Wyndham’s board unanimously rejected Choice’s proposal, calling it unsolicited, “highly conditional” and not in the best interest of shareholders. On Nov. 14, however, Choice sent a letter to the Wyndham board with an “enhanced proposal” intended to address Wyndham’s concerns about clearing federal regulations.

Among the changes proposed are:

- Reverse termination fee of $435 million, or approximately 6 percent of the total equity purchase price.

- A regulatory ticking fee of 0.5 percent of the total equity purchase price per month, accruing daily after the one-year anniversary of the signing of definitive agreements.

- Choice agrees to take any actions required by antitrust regulators to close so long as such actions would not have a material adverse effect on the combined company, subject only to agreeing to an outside date 12 months post-signing of a definitive agreement, with two 6-month extensions exercisable by either party, if regulatory approvals have not been obtained by such date.

“The industrial logic of the transaction is irrefutable, and as already discussed amongst principals and legal advisors over the past few months, this transaction is pro-competitive and the required regulatory approvals are obtainable,” Choice said in its letter. “In addition, our franchisees, many of whom own both Wyndham and Choice brands, have instantly grasped the benefits of this combination, particularly in light of rising operational costs. This combination will drive more direct bookings, lower hotel operating costs, and create a stronger rewards program. As such, we believe now is the right time to reengage in a direct and private dialogue in order to negotiate a transaction that is in the best interest of all our respective stakeholders.”

Still not enough

The proposed changes are not enough to change Wyndham’s mind about the transaction, that company said in its response to the most recent letter. For example, Choice’s offer now stands at $86 per share, below the previous $90 per share. The offered 2-year period for seeking approval of the deal with its 6 percent termination fee would actually “create a prolonged period of limbo and expose Wyndham and its shareholders to significant asymmetrical risk.”

“Choice continues to ignore our major concerns around value, consideration mix, and asymmetrical risk to our shareholders given the uncertainty around regulatory timeline and outcome,” said Stephen Holmes, Chairman of the Wyndham board. “Given they now explicitly acknowledge the legitimate issues around the regulatory timeline, they are essentially asking our shareholders to take on serious risk and accept as compensation for a failed deal a low reverse termination fee that doesn’t even begin to compensate for the potential lost earnings and long- term impairment to value that could occur during an uncertain two-year regulatory review. In line with our fiduciary duties, we will of course always evaluate any serious proposal, but Choice continues to fail to adequately address any of the three core issues we have repeatedly raised. They have instead chosen to prolong this for months with a proposal that remains unfeasible, damaging to our business, and unnecessarily distracting to our management team.”

Wyndham’s letter also claimed Choice’s offer undervalues its growth prospects and the value of its shares relative to those prospects. Wyndham’s franchisees remain “unenthusiastic” about Choice’s offer, the company said.

In a previous statement, AAHOA also opposed the deal, saying that a merged Choice/Wyndham would have 16,500 hotels with 46 brands and dominate the economy/limited service segment.

“As the owners of more than two-thirds of both Choice Hotels and Wyndham-branded hotels, AAHOA members have much at stake with Choice’s potential purchase of Wyndham,” said AAHOA Chairman Bharat Patel. “To have one franchisor Choice Hotels control so many economy and limited service hotels will give our members little opportunity to have a say in whether the franchise mandates and requirements are fair, and significantly limit their options to find a different brand under which they could successfully operate their hotels.”