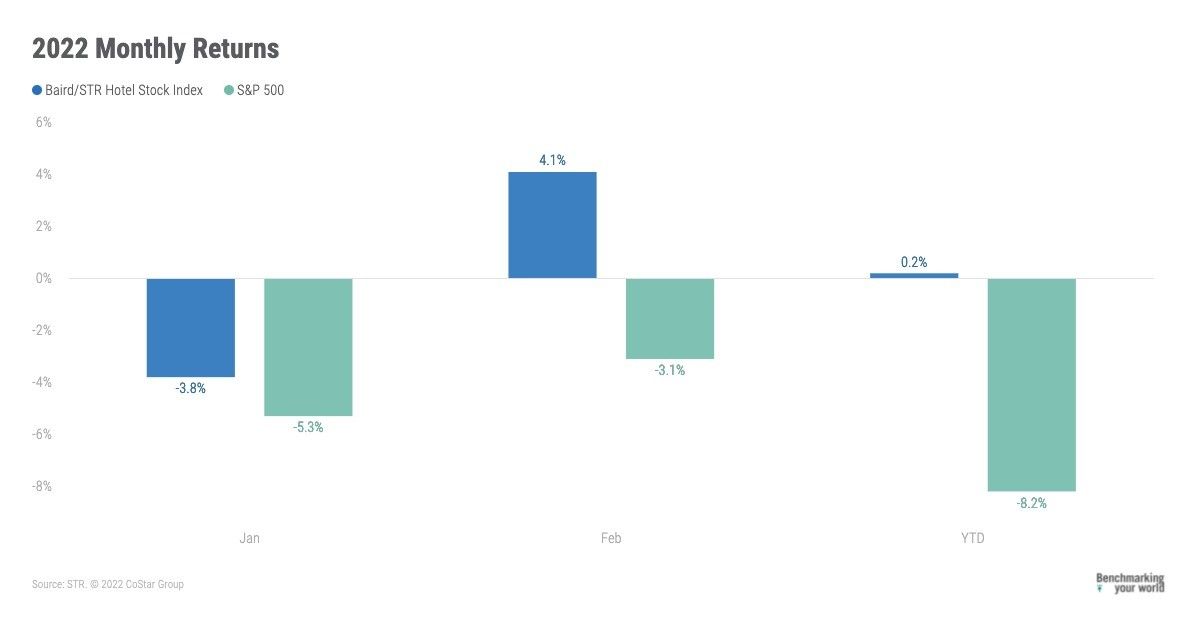

THE FIRST TWO months of 2022 saw up and down performance by Baird/STR Hotel Stock Index, according to STR. In January, the index sank, then in February it rose again, regaining lost ground.

In January, the index dropped 3.8 percent after rising 12.7 percent in December. The index still outperformed both the S&P 500, which dropped 5.3 percent that month, and the MSCI US REIT Index, which dropped 7 percent. The hotel brand sub-index fell 4.3 percent from December and the hotel REIT sub-index declined 2.2 percent.

“Despite the significant stock market volatility to start the year, both the hotel brands and hotel REITs outperformed their respective benchmarks in January, which continued the momentum from the end of 2021,” Michael Bellisario, senior hotel research analyst and director at Baird, said at that time. “Positively, Omicron-related concerns are slowly subsiding, and investors are looking forward again. At the same time, leisure demand remains robust, optimism regarding a more normalized travel environment is building, and the broader growth-to-value rotation has benefitted hotel stocks as inflation pressures remain front and center.”

The results for the month did not surprise Amanda Hite, STR president.

“As expected, January U.S. hotel performance came in lower than the month prior, as leisure consumers stayed closer to home after the holidays and business travel remained hampered by work-from-home protocols,” Hite said. “Room demand was also affected by severe weather and corresponding flight cancelations. The one bright spot in the numbers is ADR, which continues to show robust recovery across the spectrum.”

The index rose again in February, however, up 4.1 percent for the month and a 0.2 percent rise for the first two months of the year.

In February, the Baird/STR Hotel Stock Index outperformed both the S&P 500 (-3.1 percent) and the MSCI US REIT Index (-3.3 percent). The hotel brand sub-index jumped 4.2 percent from January, while the hotel REIT sub-index increased 3.5 percent to 1,269.

“Hotel stocks posted gains in February and were relative outperformers for the third consecutive month,” Bellisario said. “Despite increased stock market volatility and growing geopolitical concerns, investors remained focused on the reopening momentum and improving demand trends as Omicron-related disruptions are in the rearview mirror and corporations’ back-to-office plans are moving forward. A more normalized travel environment is expected to unfold over the next several months, in our opinion, and we are keeping a close eye on rising gas prices and any potential impact on near-term drive-to leisure demand.”

Hite expects demand to rise as the pandemic ebbs.

“The decline in Omicron cases and subsequent easing of mask mandates and restrictions is expected to have a positive impact on spring room demand in both the corporate and leisure segments,” she said. “Occupancy and room rates showed continued improvement in February with limited-service hotels displaying the most substantial gains toward pre-pandemic levels. While nominal ADR has been at or above 2019 comparables, inflation pressures continue to weigh on owner and investor minds as these healthy room rates are not translating to equally strong profit growth as expenses, especially labor costs, continue to rise.”